Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Gold and Silver News

From Guardian Vaults

Gold Hits Lowest Level Since March 2020

It has been quite a volatile start for precious metals in 2021. Right when gold looked to be breaking out to the upside, we saw US Bonds sell off, pushing the yield on a 10-year Bond to the highest since March of 2020, above 1.18%. Gold took a sharp dive in response. We noted in our Gold 2021 Report the importance of US Bond yields on precious metal prices for this year, and we are seeing this short-term trend higher in yields impacting prices already.

This combining with a very strong Aussie dollar has given us the lowest gold price since March 2020 in AUD terms, below $2,400. Long term investors will know that the market oscillates in about a 20% range intra-year, so won’t be too concerned with the current short-term weakness in metals, however new investors may be scratching their heads and getting a bit worried and might often miss the best opportunities to buy into oversold conditions.

With the Biden administration likely to be very keen on spending lots of money they don’t have in 2021, we can assume more US debt to be issued and the Fed to step in and expand their bond buying program in response. Both US interest rates and bond yields should stay low for a very long time, so we see this event as a short-term blip in markets and not a longer-term significant change of trend.

Biden has already launched a $2.4 Trillion “American Rescue Plan” to stem the virus and help the economy. US jobs numbers upset to the downside last week with 965,000 new Americans filing for unemployment benefits as the country struggles with record COVID deaths and case numbers. A truly bleak and terribly challenging environment is being completely shrugged off by the stock market which is experiencing a complete detachment from reality in blind optimism. It is a truly remarkable period for financial markets and one that may be looked back on similar to that of 1929 or 1999.

It has been quite a volatile start for precious metals in 2021. Right when gold looked to be breaking out to the upside, we saw US Bonds sell off, pushing the yield on a 10-year Bond to the highest since March of 2020, above 1.18%. Gold took a sharp dive in response

How High Can the AUD Fly?

Over the past few months, the AUD trend has been textbook from a simple trendline perspective as we can see in the chart below. We were quickly approaching 78 US cents which have been suppressing metal prices for local investors. One hope for those trying to pick a bottom in AUD gold is that we have just broken south of the trendline that was acting as support in recent trading sessions. If the AUD finally starts rolling over here it could help put a floor in the recent trend lower in metals.

One interesting thing to note is that the AUD strength has more accurately been due to USD weakness more than anything, but it seems some AUD bulls have entered the long trade in 2021 with the AUD/EUR finally breaking out of its recent trading range as seen in the chart below. Arguably Australia has handled the COVID pandemic much better than the US or Europe which has led to our economy not being as negatively affected. A bit of luck thrown in the mix with a bull run in just about every commodity on the planet has also helped the Aussie along.

As for targets, we can’t discount the possibility of trading into the USD 80c range this year if we see the surge in commodities prices continue. However; a higher AUD does not necessarily mean lower gold prices for investors. In fact, from March 2020 to August 2020 the AUD/USD rose from 55c to 72c, yet gold in AUD terms still managed to rise from $2,350 to $2,850 in the same timeframe. It all depends on money flows and the comparative performance of metals. Metals simply need to rise at a faster clip than the AUD to still see positive returns for local investors, so AUD strength shouldn’t be a sole reason to avoid metals exposure and should just be seen as an opportunity to pick up metals at better prices taking full advantage of a stronger currency whilst it lasts.

In a commodities bull market, like we are seeing, it does make sense for the AUD to gain some ground on the USD, but I’d assume all currencies globally will see commodities move a lot higher over the long term, as Central Banks continue to keep the printing presses running and the USD continues to weaken.

Wall Street Bets

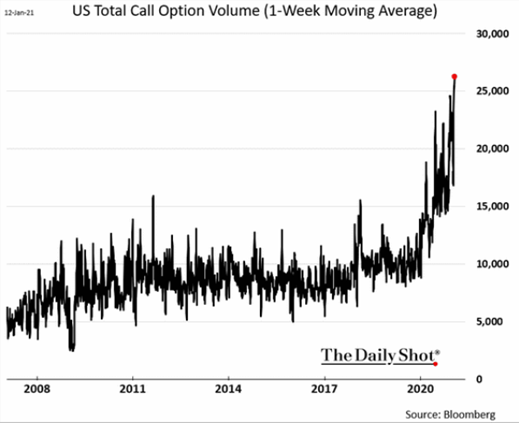

An interesting phenomenon that starting during COVID lockdowns in 2020 has been the explosion of online share trading and options volume in the US. Call options are a much riskier way to bet on share prices rising which can have multiple times the profit or loss one might get from owning a simple share. When you combine this with leverage, you can have some pretty ridiculous exposures with small account sizes, which is exactly what we are seeing become the most popular new form of gambling on platforms such as Robinhood.

One Reddit account which is famous for contributing to the explosion in popularity of call options is r/wallstreetbets, which now has over 1.8 Million subscribers. If anything, it is worth a follow purely for entertainment purposes, but what started as a joke has ballooned to a point where the group has an actual significant impact on the US share market. Leveraged call options are often hedged by those writing the calls who want to reduce risk, so it often leads to market makers being forced to buy common stock in an attempt to minimise their losses. The higher call and put option volume, or the more popular these products are, the higher the volatility and trading volumes in individual stocks will be.

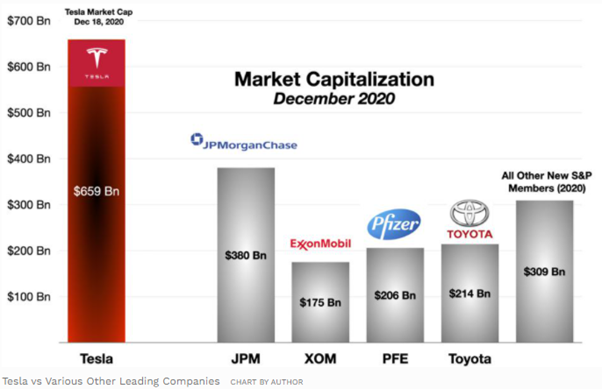

We have seen this recently with the example of Tesla, with call options volumes through the roof leading to the stock having daily trading volumes at absurd levels and the market cap reaching an almost $700 Billion valuation. Just this week a colluded effort on the r/wallstreetbets Reddit page was arranged to create a short squeeze on the heavily shorted stock of GameSpot ($GME). The video game retailer has struggled in the recent past, but enough people got together to buy shares and options forcing shorts to cover and the stock jumped 60% in a day. When you get enough people together following the same memes on internet forums with no regard to risk you start seeing some crazy things. The level of risk-taking in the US stock market right now is at an extreme when you consider the country is grappling with one of the biggest economic challenges of the past 100 years.

Generally, when equity markets experience higher levels of volatility you usually see inflows start moving into safe-haven assets, like gold. We have largely seen the bigger moves in US stocks to the upside of late, so this is yet to play out, but all bubbles burst eventually and the more stretched the valuations are at the top, the greater the room for a very large potential sell-off. The market’s attitude towards risk right now is borderline delusional, so it makes sense to look at both your individual and superannuation portfolios very carefully if you want to de-risk some exposure away from one of the most heated stock markets in the last century.

John Feeney

Guardian Gold Sydney

If you have any feedback or questions about this report, you can contact John Feeney direct at johnf@guardianvaults.com.au or on Twitter @JohnFeeney10

To find out more feel free to call through and speak to one of our representatives or email your questions to sydney@guardianvaults.com.au

______________________________________________________________________________________________

Click to see our latest bullion deals on metal in stock at low premiums.

______________________________________________________________________________________________

https://www.pewresearch.org/science

https://tradingeconomics.com/united-states/government-bond-yield

https://www.fxstreet.com/analysis/the-santa-rally-approaches-a-halftime-break-202011200038

https://www.intellinews.com/attack-of-the-debt-tsunami-global-debt-soars-to-a-new-all-time-high-196972/

https://fred.stlouisfed.org/series/M2https://stockcharts.com/h-sc/ui

https://www.businessinsider.com.au/warren-buffett-indicator-nears-record-high-signals-stocks-risky-overvalued-2020-11?r=US&IR=T

https://www.multpl.com/shiller-pehttps://www.tradingview.com/chart/?symbol=SP%3ASPX

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.