Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Gold and Silver News

From Guardian Vaults

Silver Price & Demand Outlook

Silver Price & Demand Outlook

Silver Price & Demand Outlook. Last Friday saw the first big miss in US employment figures for quite a while. Expectations were for 720,000 jobs to be added in the non-farm payrolls data for the month of August, but the number fell well and truly short at only 235,000. The US dollar dropped, gold caught a bid, but silver was the stand out, jumping over 3% to $AUD 33.30 per ounce.

We’ll take a good look at the silver price in this week’s update and touch on some more longer-term dynamics at play in the coming years.

There has been a lot of talk about the potential for the Federal Reserve to start tapering back on its bond buying program, but the underlying economy needs to remain relatively strong for it to do so. The weak jobs numbers last week, which missed forecasts by a mile, clearly threw some doubt in the mix as to whether or not the economy was ready to handle some monetary tightening from the Fed. One day, eventually, markets should wake up to the fact that the Fed cannot tighten monetary policy and normalise interested rates without severely negative consequences. The debt burden of governments, corporates and individuals rely on ultra-low interest rates without causing a bust. Fed chair members however, do like to talk about tightening a lot though, pretending that they have an end-game or an exit strategy, which they don’t. The world is addicted to cheap debt and free money, so it’s hard to take that away easily.

Both gold and silver therefore tend to react positively whenever there is any underperformance of major US economic data, so it pays to watch the monthly numbers closely. The weaker the underlying US economy, the more monetary stimulus is needed to keep things running and the fiat money taps should eventually lead to a deterioration of the purchasing power of the currency, which gold and silver provide safety from. But there are other key uses for silver in industrial applications that are more rarely covered in the news.

Silver: An Industrial Metal for the Future

Silver is the best electrical and thermal conductor of any metal on the planet; hence why it plays an important role in systems that require an efficient use of electricity, such as solar PV panels and electric vehicles (EVs). Silver shouldn’t be seen as a ‘barbarous relic’, but a metal for the future, as its industrial application is only growing with greater renewable energy adoption and the rise of electric vehicles. Electric vehicle technology is surpassing internal combustion engine (ICE) capabilities and the climate change problem that governments face collectively is not likely going away any time soon. On a global scale, governments are committing to renewable energy investment, which is a very good thing for long-term silver demand. A recent Forbes article covered a quick summary of some recent developments and investments in renewable infrastructure, but there is many more than what is listed here:

- Globally, $141 billionwas spent on solar energy technology development in 2019.

- In the U.S., solar energy is expected to comprise 48%of renewable power in 2050 (up from 11% in 2017).

- S. solar capacity eclipsed 100 gigawattsfor the first time in 2021.

- Globally, the number of EVs on the road rose 43%in 2020 over the previous year.

- As part of his infrastructure plan, President Biden has proposed$174 billion in direct support for electric vehicles (EVs) with a goal of creating 500,000 EV chargers nationwide.

A lot of the physical demand that will come from the push towards renewable energy is yet to be seen in the silver market, but it will come. Many car manufacturers are now accepting the superiority of electric vehicles in terms of their efficiency and performance, which only gets better each year. A race has already begun for major brands to make a big shift towards EV’s by 2030. Hyundai’s luxury brand ‘Genesis’ is said to be moving to 100% EVs by 2030. Nissan is targeting 40% of US sales to be EV by 2030. Mercedes aims for around 50% of sales, and even higher performance brands such as Porsche are looking at expanding their EV range of vehicles to 80% of global sales by 2030. Far more silver is required in EV’s than traditional ICE vehicles, so we expect this to be a major driver for increased industrial demand in the years to come.

Supply & Demand Breakdown

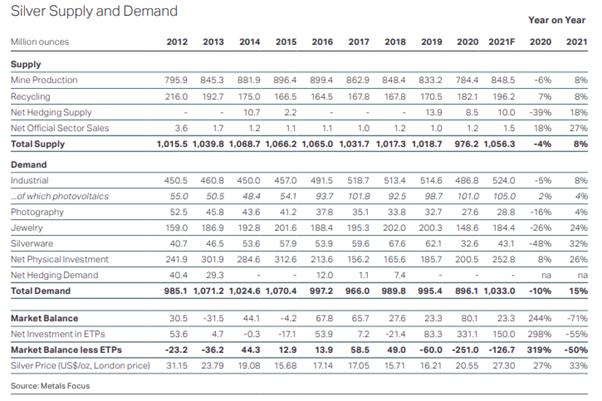

If we were to break down the silver markets supply and demand fundamentals, not a lot has changed in the past decade. According to the Silver Institutes World Silver Survey, silver supply as a total, which includes recycling, has remained very stable at circa 1 billion ounces per annum since 2012. Demand too, since 2012, has ranged between 900 million and 1.1 billion ounces per year, again very stable. Industrial demand has grown from 450 million ounces in 2012 to 524 million ounces today, but quite a modest increase and nothing spectacular yet. One significant growth area that sticks out is solar PV demand, which grew from 55 million ounces in 2012 to over 100 million today.

What isn’t on the chart below is a separate column for electric vehicle demand, which is said to grow to circa 90 million ounces by 2025. If we see EV demand at 90 million ounces in 2025, we are also assuming this sector to only increase much further by 2030, given that many commitments by auto makers have a 2030 target and not 2025. Silver EV demand could conservatively grow to reach a level of more than 10% of total silver demand globally (circa 105+ million ounces). This is a big deal, as given the silver supply outlook remains incredibly stable, we could easily see a very decent deficit in the silver market in the years to come, thanks to electric vehicle adoption. Even if the market in future years was in a 10% deficit or less, that could still have massive implications for price rises as talk of supply deficits often feed through to the investment sector, sparking additional investment demand by speculators.

The other big change in the above chart is the recent spike in “Net Investment in ETPs” (or exchange-traded products) which jumped to over 300 million ounces in 2020. These are silver investment vehicles such as ETF’s which trade easily on exchanges and generally have investors speculating on price, without taking physical delivery. The growth in these products have exploded in 2020 as silver is becoming more of a mainstream investment, which helped the price appreciate to where we are today.

The future industrial demand story as highlighted above is clearly impacting investors appetite, so the larger the silver market falls in to a supply deficit in future years, the higher the likelihood of investment demand and ETP flows. This snow balling effect can naturally lead to further deficits in supply, and significant resets in the price.

Silver has a monetary history that remains today, as a lot of investors still prefer to hold their wealth in silver coins and bars, rather than paper with infinite supply (fiat currency). Investors also flock to the metal in a safe haven rush at times, so the price does benefit greatly from an increase in ‘monetary’ demand. But the real driver we see for future demand sits with its immense industrial applications and the new growth sector of electric vehicles. Unlike the silver spot price, the growth in industrial demand is quite stable and predictable, but the underlying price is known to move about in dramatic fashion. Investors should think about the long-term implications for silver and not get too caught up in daily or weekly moves. Sharp price drops should be seen as opportunities, as the price itself does not signal a change in the long-term fundamentals. Silver is a much smaller market than gold, so it will behave in a more irrational and volatile way at times.

Silver Price Chart in $AUD (2000-2021)

Regardless of volatility or future prices, we are no doubt going to see circa 100 million ounces per annum of new additional silver demand coming from the EV sector in future years, which will likely send the overall market into a supply deficit. Silver is a unique metal that is not easily replaced by an alternative when electrical efficiency in the number one goal. Investors should feel confident in the longer-term tailwinds that benefit the silver market, as these are in our opinion, even much stronger than those benefiting gold.

Regardless of volatility or future prices, we are no doubt going to see circa 100 million ounces per annum of new additional silver demand coming from the EV sector in future years, which will likely send the overall market into a supply deficit.

Until next week,

John Feeney

If you have any feedback or questions about this report, you can contact John Feeney direct at johnf@guardianvaults.com.au

Or on Twitter @JohnFeeney10

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.