Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Gold and Silver News

From Guardian Vaults

Lockdowns to crush Australia’s GDP

Lockdowns to crush Australia’s GDP

As lock downs continue across Sydney and other parts of the country, there is a significant economic cost which will no-doubt influence both government and central bank policy decisions, and should impact asset prices moving forward. Domestic gold investors have seen local prices buoyed by the falling AUD/USD which has retreated from 77c in June to 73.50c at time of writing, with a chance the AUD continues to lose ground if the lockdowns last longer than expected.

In this week update we will have a greater focus on the Australian economy and take a look at the current lock down situation from an economic impact point of view.

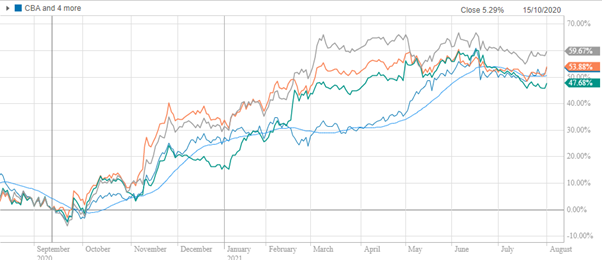

The Australian economy is at a fascinating point and faces a big challenge with the delta variant spreading uncontrolled through NSW and now other states. There are currently some major differences in the underlying economy and asset prices, so it will be very interesting to see how long this disconnect continues. Obviously, lock downs are terrible for the economy and employment. Small businesses suffer, individuals suffer and the government budget suffers due to the increase in emergency payments needed and higher unemployment. It seems no good could come from it. Yet, the share price of major banks are up 50% in the past 10 months, and Sydney property prices are up 14% since the start of the year. Go figure.

CBA, WBC, NAB & ANZ

Even for the month of July, Sydney property prices were reportedly 2% higher, with the median house value hitting an eye watering $1.26 million, and apartments hitting $810,000. It makes you wonder who all these millionaires are when you consider the sheer numbers of Sydney siders who are struggling to get by. If a decent percentage of the buyers are financing a significant portion, it also makes you wonder how poor the risk assessment must be for lenders. It is hard to imagine bank shares and property prices continuing along at the current clip if lockdowns continue; but I guess under 0% interest rates at the central bank level, you tend to see some crazy things across financial markets.

The demand for property under current interest rates seem insatiable. But part of the urgency to lock in loans for properties well over reserve must also have something to do with the fear of missing out, and buyers focused entirely on past performance. Lock downs have longer lasting implications too, so a lot of businesses can’t just re-open the doors when it ends, and many can’t simply go back to their jobs that no longer exist. So, lenders have a major risk here of increasing loan defaults on the horizon. The dream run in Sydney property is well overdue for an ugly shock, so let’s see how that pans out over the coming months. With the potential of a recession by December this year, we can expect our household debt /GDP ratio to hit a fresh new all time high.

If we look at some specific numbers being thrown around, Josh Frydenburg has stated that the estimated cost of coronavirus lockdowns Australia-wide would be in the region of $300 million per day. NSW alone is looking like taking a $13 Billion hit in this quarter. ANZ is estimating a 1.3 percent contraction in AUS GDP for the current quarter, with CBA being far more bearish, expecting a 2.7 percent slump. That is just for this quarter, so if things continue longer, it will obviously be an even bigger contraction and an official ‘double dip’ recession.

There still remains a lot of uncertainty as to when the Sydney lockdowns will end. Having the target for when lockdowns should end being based on vaccination numbers versus actual cases in the community also seems an odd strategy. I guess what it tells us is that the NSW government does not expect to be able to eliminate the current outbreak like they did with the northern beaches cluster. Perhaps the spread has now been too far and is beyond the capabilities of contact tracing. The unfortunate message between the lines here might be that Sydney siders will be expected to live with the virus moving forward and that we will likely never get on top of case numbers despite the efforts of the lock down. Australia’s dream run of covid avoidance might have finally come to an end.

Although picking what happens in certain asset prices in these sorts of events can often be difficult; due to the counterintuitive nature of how markets react to bad news (bad news often being good news), one thing that is easier to predict is that the currency will no-doubt be sacrificed. More government stimulus means a bigger pile of debt, that eventually gets monetized through the RBA’s bond buying program, essentially increasing the money supply and destroying the purchasing power of the currency. The lockdown’s impact on the economy also leads to additional government stimulus even after the event and accommodative policy from the RBA for some time too. We can expect the Aussie economy to follow in the US footsteps by taking rising inflation as a tradeoff for fiscal and monetary stimulus.

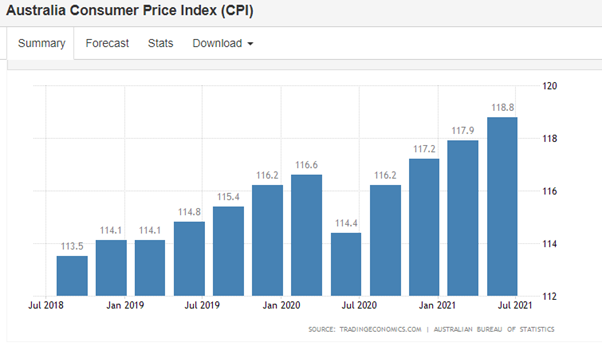

The Australian CPI has been rising gradually as seen in the chart below as the currency continues to lose ground against other majors. With a contraction in the September quarter almost a certainty, the technical recession will only be official with a December quarter contraction. Many economists expect a rebound in the December quarter, but that might be a little optimistic at this rate.

Although gold and silver haven’t been too exciting in recent months, then again, often they’re not supposed to be. The goal moving forward should be one of wealth preservation. The ongoing problem of COVID-19 simply means more government and central bank stimulus, an ever-increasing pile of government debt, and currencies thrown in the furnace in the attempt to fix any and every economic problem. But money doesn’t fix everything, you can’t simply paper over every problem. There are structural imbalances in the economy that will come as a result of all this and many asset prices are not pricing in anywhere near as much risk as they should be.

As lock downs continue across Sydney and other parts of the country, there is a significant economic cost which will no-doubt influence both government and central bank policy decisions, and should impact asset prices moving forward. Domestic gold investors have seen local prices buoyed by the falling AUD/USD which has retreated from 77c in June to 73.50c at time of writing, with a chance the AUD continues to lose ground if the lockdowns last longer than expected.

In this week update we will have a greater focus on the Australian economy and take a look at the current lock down situation from an economic impact point of view.

Until next week,

John Feeney

If you have any feedback or questions about this report, you can contact John Feeney direct at johnf@guardianvaults.com.au

Or on Twitter @JohnFeeney10

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.