Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Gold and Silver News

From Guardian Vaults

Gold bounces back

Gold bounces back

“Watch out for many news articles from mainstream press this week talking about how bearish precious metals are, as journalists tend to only ever comment on what has happened in the past, not what will happen the future. They also tend to be most bullish at market tops, and most bearish at market bottoms, so as a contrarian indicator, we would be surprised to see metals move lower after such a high volatility event, and expect metals prices to recover higher in coming weeks form here. Ignore the noise, as the event is merely a blip in the longer-term picture and one that will be forgotten about in a few months’ time.”

So, it seems the flash crash event of last Monday the 9th of August was indeed a buying opportunity, as gold has now quickly recovered off the lows and rallied higher beyond both the flash crash open price and even past the initial sell-off on stronger than expected US jobs numbers.

The gold price in AUD terms has added $170 per ounce since the intraday low of $2,300 on the 9th of August, potentially catching many off guard. We covered the probable reasons behind the flash crash in last week’s update in depth, and one of the potential causes could have been a strategic trade by one or more large entities coordinating to trigger a stop loss cascade during a time where the environment was perfect to do so. If that was the case, it seems quite obvious the objective was to then go long the yellow metal after the forced liquidation. But we can only speculate based on what the price action tells us:

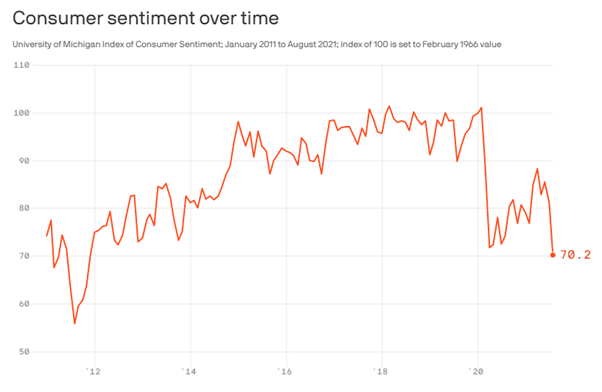

We did have some negative economic news coming out in the past week with US consumer sentiment plunging to the lowest level since 2011, which helped push gold higher on a weaker USD. The delta variant is still creating problems for the US economy and we can only guess when and what the next variant will be.

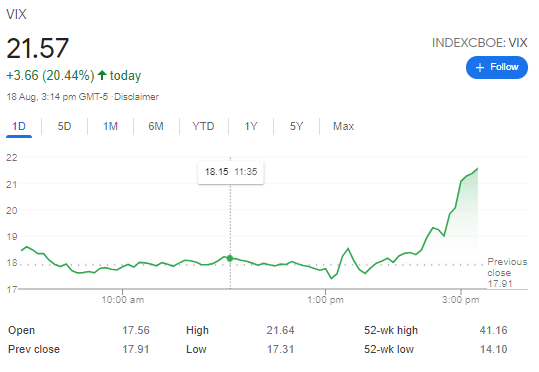

With consumer sentiment plunging in the US this can have knock on effects to both consumer spending and potentially stock market performance as individuals move towards hanging onto their cash, rather than splurging on things they don’t need, or throwing money at an excessively bubbly stock market. The survey’s chief economist Richard Curtin says, “The extraordinary surge in negative economic assessments also reflects an emotional response, mainly from dashed hopes that the pandemic would soon end.” It is true that the emotional drain of the covid pandemic must certainly be taking its toll on the US now, and the enthusiasm in the stock market is getting a bit long in the tooth. One sign that we could be in for some equity market volatility very soon would be the price action in the VIX volatility index, which spiked 20% overnight. The US stock market is well overdue for a wakeup call and correction so we still wait for this to play out. Perhaps stock market volatility will be the next driver of precious metals prices in the short-term, as a fear trade/flight to safety trade kicks in.

One important thing to watch closely for domestic investors at the moment is the AUD/USD, which continues to come under pressure with our unknown lockdown situation impacting the economy. The AUD now trades in the 72 US cent range and looks to be somewhat of a falling knife. Regardless of your opinion on what is best for the country and economy in the long run, there is no doubt that covid lockdowns are having a very large and negative effect on the Australian economy. Strange to see Aussie banks and property analysts still forecasting much higher property prices in 12 months, as that simply doesn’t make any sense (unless interest rates were to go deeply negative). What’s more likely is that we face a major credit crunch as the number of mortgages dished out to those now relying on government support starts to have an impact. There is no end in sight for the Sydney lockdown currently and the AUD/USD is giving no signal of reversing as yet either.

The other major news item since last week was the Taliban takeover in Afghanistan, which didn’t really impact precious metals prices too much. The Monday morning open was incredibly calm after the news that Kabul had been taken over the weekend, so I guess the gold market expected it to happen sooner or later. What it means from a long-term perspective, is that geopolitical tensions are most likely to continue to worsen. One aspect of war that is inevitable is the monetary aspect of the participants. Wars are incredibly expensive and the US apparently spent $300 million per day for 20 years fighting the Taliban. As a Forbes article summed up, the US paid for it with debt of course, with some $500 billion in interest payments alone so far. Brown University researches estimate that by 2050 the cost of interest alone could reach $6.5 Trillion dollars, or $20,000 for each and every American citizen. Given the US will likely never come back to a government surplus it is weird to think the cost of the war in Afghanistan could never be paid off for an eternity.

Getting back to what all this means for precious metals: the ever-growing US debt burden is never ending. The only way to deal with it effective is the print more and more money each year in order to devalue the currency that the debt is denominated in, which is why by 2050 $6.5 Trillion won’t seem like anywhere near as much money as it does today, and why gold, silver, wheat, corn, houses and basically everything else will be much higher in nominal terms by then also. The depreciation of currencies is inevitable for governments with high levels of debt, and the US government debt ceiling just keeps rising higher. Last check was $28.6 trillion.

So, it seems the flash crash event of last Monday the 9th of August was indeed a buying opportunity, as gold has now quickly recovered off the lows and rallied higher beyond both the flash crash open price and even past the initial sell-off on stronger than expected US jobs numbers.

Until next week,

John Feeney

If you have any feedback or questions about this report, you can contact John Feeney direct at johnf@guardianvaults.com.au

Or on Twitter @JohnFeeney10

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.