Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Gold and Silver News

From Guardian Vaults

A positive signal for Gold

A positive signal for Gold

This week saw the much-anticipated US CPI data for the month of June, and the not-so-transitory inflation number surprised to the upside yet again. What is interesting to note; last month the higher-than-expected CPI led to gold selling off on heightened fears of Federal Reserve tapering, however this time the higher number saw gold catch a bid, moving up through $1,825 USD.

In this week’s update we will explain why and comment on what could be a significant signal that investors could be starting to shift towards an ‘inflation-is-positive’ mindset when it comes to precious metals.

To the numbers first and the US CPI rose to 5.4% on a yearly basis, up from 5% in the previous month and well above the expected 4.9%. What was supposed to be a transitory blip in inflation (according to the Fed) is now sticking around like a bad smell and doesn’t seem to be going away. Gold shook off the previous fear of Fed tapering to rise over 1% on the day.

The numbers for June are the highest in 13 years, and to make sense of it, one should only look to the famous quote by Milton Friedman: “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

The rapid expansion of the US monetary base in 2020 was the largest in history, which leads us to believe there is a decent chance that the Fed is incorrect in its ‘transitory’ forecast. The question then becomes: if inflation is here to stay then what effect will it have on gold and silver prices?

Lately the market has been making the overly basic and somewhat juvenile connection that higher inflation must be bad for precious metals, as it will likely lead to monetary tightening. You can forgive the market for getting this wrong in the short-term as it has been such a long time since inflation was a significant problem, and the 1970’s was a decade in which many participants weren’t even born yet, let alone investing. What is significant about this month’s reaction though, is that it could be the very beginning of a shift in this sentiment, towards one of: what’s better than gold, when it comes to an inflation hedge?

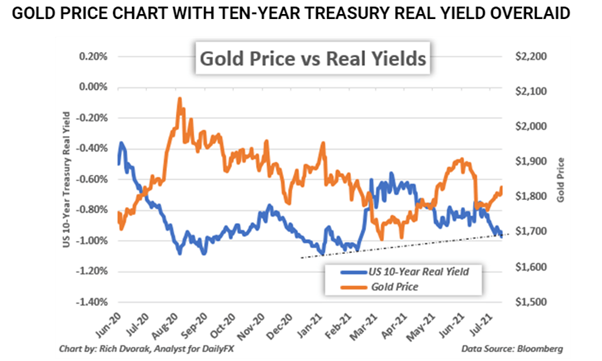

If gold starts to react positively to every inflation beat, then that could well be the signal that the market is starting to wake up to the importance of gold in an inflationary environment. The same could be said for silver, as it too can be viewed as a monetary safe haven at times, and benefit from inflation fears as well. There needs to come the realisation that both bond yields and interest rates can rise alongside gold if inflation is high enough to see deeply negative ‘real yields’. Real yields are what the market should focus on and what truly matters when comparing gold to other asset classes.

The higher inflation runs, the lower the real yield on government and corporate bonds, and the better gold looks as a safe haven alternative. It is truly bizarre to think today for the first time ever, junk rated corporate bonds are trading at negative real yields, whereas gold is languishing below the peak of the 2011 high in $USD terms (set a decade ago!). A mispricing of an un-loved asset class, but to quote Dylan; perhaps times they-are-a-changing. Don’t be surprised to see gold much higher by the end of this calendar year, if indeed we see this shift take place.

Equity Markets Breaking Records

Markets seem to be at the most distorted level imaginable. There is so much money washing around trying to find a home that eventually, surely, precious metals will get their time in the spotlight. Trillions of dollars’ worth of government and corporate debt is now trading at negative real yields. The stock market in the US has been hitting new records in both nominal terms and by many valuation measures. So, when do things peak? Are we at maximum level of bullish sentiment when it comes to equities?

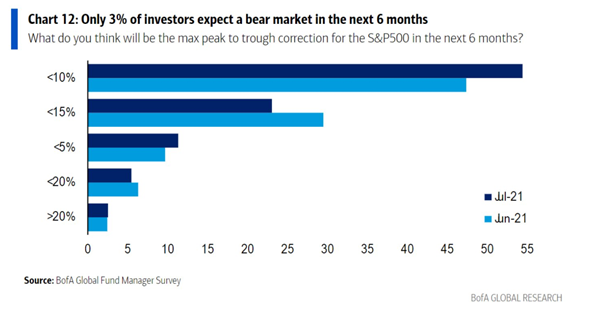

One Bank of America survey would suggest it must be close, with only 3% of investors expecting a bear market in the next 6 months. 3%! If ever there was a crowded trade it would be long US equities in 2021. They say that when everyone in on the one side of the boat you should take caution, and US investors have rarely been more bullish than today.

An astonishing chart this week via The Financial Times puts the last 12 months in to perspective. The first half 2021 inflows into global equity funds are not only the largest on record, but by a mile. About $580 Billion in cash has flooded into global stock markets in the past six months. We are talking about something that completely dwarfs anything we have seen before. Bank of America strategist estimate that if the pace of inflows continues at the same rate until the end of the year, equity funds will take in more inflows in 2021 than in the previous 20 years combined!

It is hard to imagine that the melt up in US stocks could have enough momentum to continue at the current pace until December, however it is possible. What seems impossible is that the period we are witnessing will continue over the long-term. When only 3% of participants expect a bear market in the next six months it reminds us of an old saying:

“When everyone thinks the same, nobody is thinking”

This week saw the much-anticipated US CPI data for the month of June, and the not-so-transitory inflation number surprised to the upside yet again. What is interesting to note; last month the higher-than-expected CPI led to gold selling off on heightened fears of Federal Reserve tapering, however this time the higher number saw gold catch a bid, moving up through $1,825 USD.

Until next week,

John Feeney

If you have any feedback or questions about this report, you can contact John Feeney direct at johnf@guardianvaults.com.au

Or on Twitter @JohnFeeney10

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.