Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

This year marked the 15 years in safe custody for Guardian Vaults. As the first of its kind to open in Australia, Guardian quickly established itself as the industry standard in providing safe deposit boxes and secure; fully allocated bullion storage solutions. The celebrations culminated in a red-carpet event held at the state of the art Castlereagh Street facility in Sydney attended by industry luminaries and friends of Guardian.

As well as being a time of celebration for Guardian Vaults, this milestone also provides us at Guardian Gold with an opportunity to reflect on the importance of holding gold and silver over this period. From the world changing seismic shift that was the Global Financial Crisis, to the daily installments of the Trump Show; the last 15 years have been witness to considerable market volatility and geopolitical uncertainty.

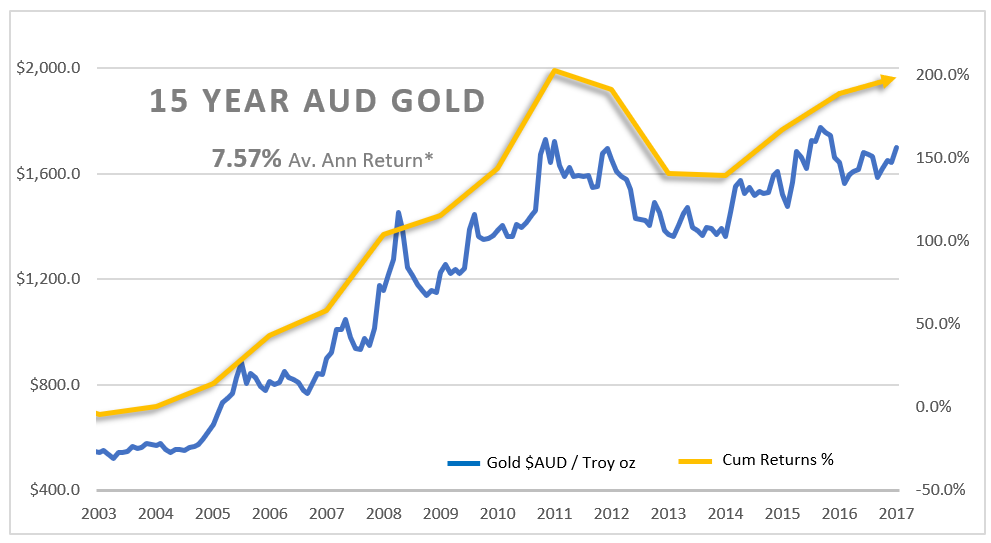

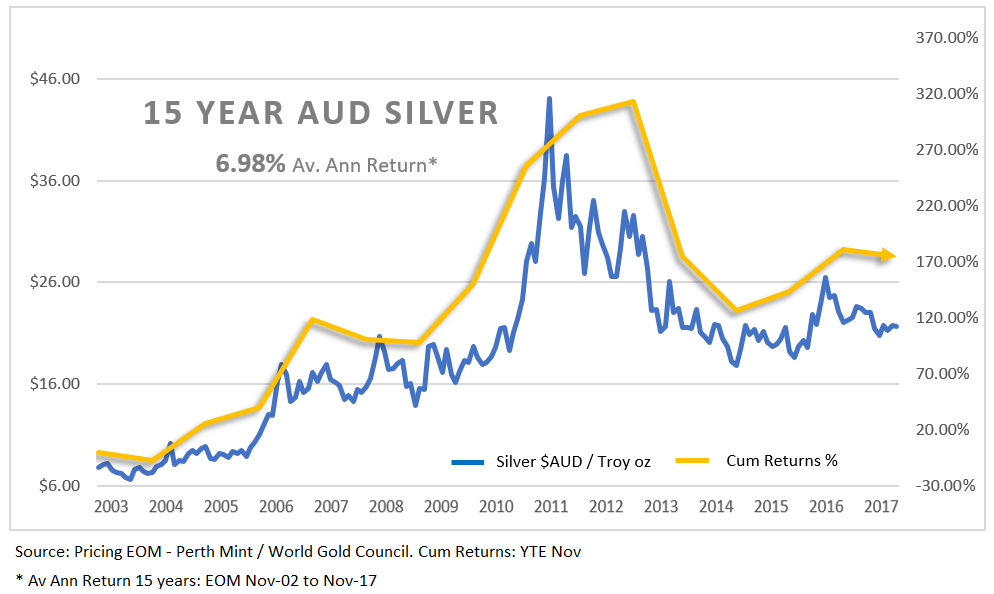

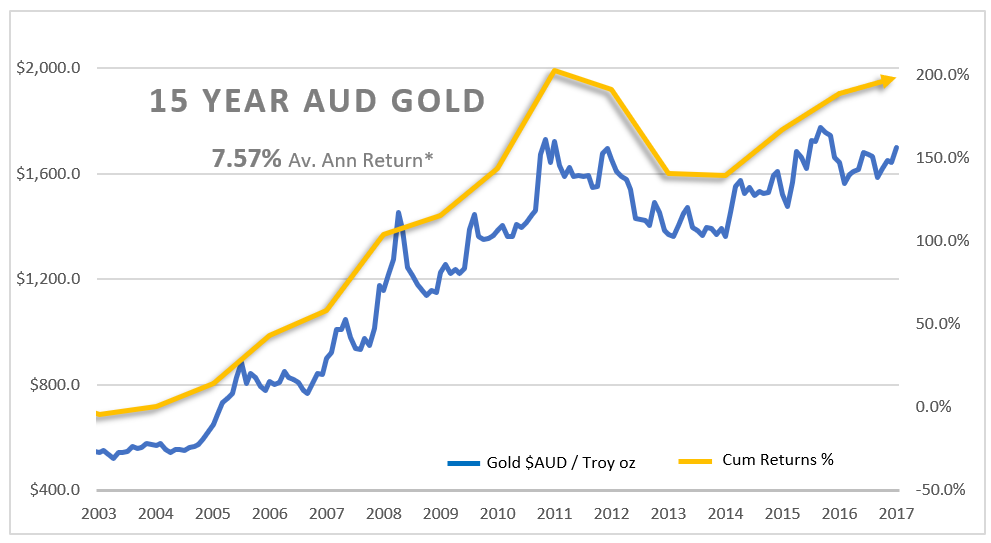

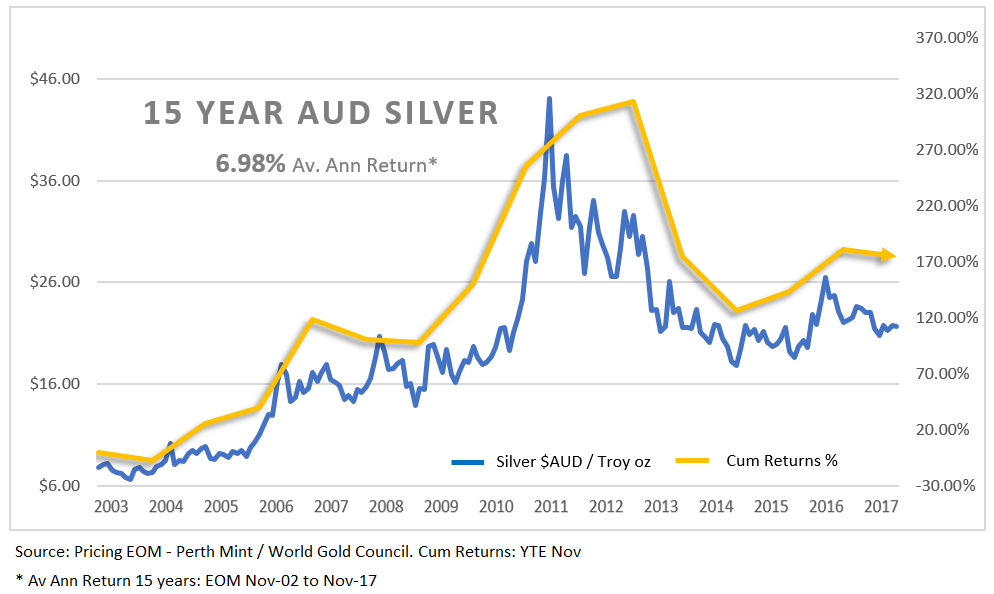

The following charts show the cumulative and average annual returns for an investment in AUD gold and silver assuming a holding between Nov ‘02 to Nov ’17

Why continue to own gold and silver in your portfolio?

Historically, precious metals have performed well in these challenging environments. Price is intrinsically linked to the ongoing confidence (or lack thereof) in the health of the economy and the actions of the governing entities. When these belief systems are tested we consistently witness a retreat into gold and silver as the global safe-haven and preeminent store of value.

Many share the belief that we are yet to fully face the consequences of those decisions that led to the GFC. The resulting global response to the crisis of fiscal bailouts and unprecedented debt creation has set-up the real possibility for future instability.

The form a response to any future crises may take is unknown. The policy of ‘printing your way out’ and interest rate cuts would have limited effect, if not already exhausted. Couple any emerging crisis with multiple over-inflated asset classes (seen across the board as a result of free money) and the outcome could be a paradigm shifting correction. Gold again would reprice to meet the market just like we saw in 2008-2013.

Even 9 years after the height of the crisis AUD gold is only 9% off its August 2011 highs of $1,830 (32% in USD terms), making it incredibly well positioned to respond to future volatility.

Industrial fabrication using silver makes up about 50% of demand each year, as opposed to roughly 10% for gold. This means price correlation between the two metals can vary significantly dependent on the health of the industrial sector.

Unrivaled as the most efficient conductor of electricity, silvers use in the circuitry of all your favorite gadgets and the solar panels of the clean energy revolution has seen strong growth in recent years. The demand for these technologies from emerging markets like China and India is expected to continue to increase with the growing appetites of the burgeoning middle classes.

It’s always healthy to take stock and reaffirm your reason for investing regardless of the asset class. Gold and silver are unique in that they don’t generate an income stream and have little to no correlation to other traditional assets. They are a hedge against a paper world of unforeseen events, a way to secure a portion of your wealth as a form of downside protection; this remains as true today as it was 15 years ago.

Gold and Silver News

From Guardian Vaults

15 Years of Safe Custody, 15 Years of Precious Metals

This year marked the 15 years in safe custody for Guardian Vaults. As the first of its kind to open in Australia, Guardian quickly established itself as the industry standard in providing safe deposit boxes and secure; fully allocated bullion storage solutions. The celebrations culminated in a red-carpet event held at the state of the art Castlereagh Street facility in Sydney attended by industry luminaries and friends of Guardian.

As well as being a time of celebration for Guardian Vaults, this milestone also provides us at Guardian Gold with an opportunity to reflect on the importance of holding gold and silver over this period. From the world changing seismic shift that was the Global Financial Crisis, to the daily installments of the Trump Show; the last 15 years have been witness to considerable market volatility and geopolitical uncertainty.

The following charts show the cumulative and average annual returns for an investment in AUD gold and silver assuming a holding between Nov ‘02 to Nov ’17

Why continue to own gold and silver in your portfolio?

Historically, precious metals have performed well in these challenging environments. Price is intrinsically linked to the ongoing confidence (or lack thereof) in the health of the economy and the actions of the governing entities. When these belief systems are tested we consistently witness a retreat into gold and silver as the global safe-haven and preeminent store of value.

Many share the belief that we are yet to fully face the consequences of those decisions that led to the GFC. The resulting global response to the crisis of fiscal bailouts and unprecedented debt creation has set-up the real possibility for future instability.

The form a response to any future crises may take is unknown. The policy of ‘printing your way out’ and interest rate cuts would have limited effect, if not already exhausted. Couple any emerging crisis with multiple over-inflated asset classes (seen across the board as a result of free money) and the outcome could be a paradigm shifting correction. Gold again would reprice to meet the market just like we saw in 2008-2013.

Even 9 years after the height of the crisis AUD gold is only 9% off its August 2011 highs of $1,830 (32% in USD terms), making it incredibly well positioned to respond to future volatility.

Industrial fabrication using silver makes up about 50% of demand each year, as opposed to roughly 10% for gold. This means price correlation between the two metals can vary significantly dependent on the health of the industrial sector.

Unrivaled as the most efficient conductor of electricity, silvers use in the circuitry of all your favorite gadgets and the solar panels of the clean energy revolution has seen strong growth in recent years. The demand for these technologies from emerging markets like China and India is expected to continue to increase with the growing appetites of the burgeoning middle classes.

It’s always healthy to take stock and reaffirm your reason for investing regardless of the asset class. Gold and silver are unique in that they don’t generate an income stream and have little to no correlation to other traditional assets. They are a hedge against a paper world of unforeseen events, a way to secure a portion of your wealth as a form of downside protection; this remains as true today as it was 15 years ago.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.