Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Gold and Silver News

From Guardian Vaults

Gold & Silver Outlook – 2021

Introduction

With 2020 quickly coming to an end, precious metals are looking to post another strong year of gains, with gold in AUD delivering close to 12% returns and silver looking to post a 20% return if it can maintain current levels. That would mark silver’s best year of this decade, and a very respectable return for Gold in 2020. With so many uncertainties on the table, 2021 is no doubt poised to be an eventful year for financial markets and a very difficult year to navigate.

This year, the initial uncertainty around COVID-19 was definitely a main driver of safe-haven demand, as money flowed out of risk assets and into government bonds and precious metals in the first few months of the year. The economic impact that followed was, by some measures, the worst crisis since the great depression.

What is surprising as we close out the end of the year, is that equity markets globally have already recovered most, if not all of the losses from earlier in the year. If stock markets were priced for perfection before the crisis, then we certainly are in for an interesting year for equities in 2021 if a complete economic miracle doesn’t come to fruition.

There are many possible tailwinds for precious metals next year and we will cover some areas to focus on. The risk of a major shock in the US share market has to be on investors’ minds given current valuations. The amount of negative-yielding government debt is also a big factor for gold performance, and one area which is often underplayed by Central Banks is the level of global debt, which is spiraling out of control.

US Bond Yields

For those new to precious metals it is important to understand the connection with global bond yields and the price action in precious metals. The lower the current yield on a US Treasury Bond, the more attractive zero yielding gold looks as an alternative store of value. Particularly important is the relationship between ‘real yields’ and gold price performance. Real yields are your return on government bonds after compensating for inflation, and generally speaking the lower real yields are globally, the greater the demand for precious metals.

We can see in the above chart that the yield on 10-year US Government Bonds bottomed in August of 2020. It is no coincidence that Gold topped out at exactly the same time. Since August we have seen a gradual trend higher in the 10Y yield as money has moved out of bonds and into equities as investors became more optimistic about the COVID-19 vaccine outlook moving forward.

This trend higher in the 10Y yield is important for both gold and silver as it has kept a lid on prices in the past few months. So, what we could see between now and the very early few months of 2021 could be a peak in US treasury yields on the back of a peak in optimism around a COVID-19 vaccine. The news around vaccines is clearly having a big impact on financial markets, however what we think is more likely is that despite market participants optimism, a vaccine in the US is unlikely to be taken by the vast majority unless it is mandatory (which is highly improbable), so how effective a vaccine will be is still a massive unknown at this stage.

There is a possibility of both gold and silver drifting lower in the near term if vaccine optimism continues to outweigh the negative global economic data feeding through. However, there is a strong chance that metals could bottom in late 2020, or early 2021 as it is very unlikely that the US economy makes a perfect rebound, even if a vaccine is successful. From a recent survey, only about half of US adults say they would ‘probably’ or ‘definitely’ get the vaccine. So how effective that will be in returning the US economy back to normal is a big unknown for 2021.

Given the levels of global debt were already unsustainable before the crisis, let alone after the crisis, we are likely to continue to see Central Banks expanding their balance sheets throughout 2021 and keeping interest rates steady or lower. This should keep a lid on bond yields and support metals through the later half of next year.

With 2020 quickly coming to an end, precious metals are looking to post another strong year of gains, with gold in AUD delivering close to 12% returns and silver looking to post a 20% return if it can maintain current levels.

Gold Seasonality

Perhaps coinciding with the stock markets annual “Santa clause rally” is gold’s seasonal weakness in December. We can see in the chart above that for four of the past five years, gold showed weakness and made a significant low in the month of December. You could look for reasons why this is the case, but generally when markets become optimistic and positive about the future, you usually see money flow into equities and out of safe havens such as gold.

It could purely be psychological, but there is no doubt that December is the best month of the year for inflows into global equities as seen in the chart above. One cannot discount the role that mass psychology plays in financial market so perhaps the anticipation of an upcoming holiday is enough to get investors to sell gold and buy stocks in December.

Looking back on the past five years December has been a great buying opportunity for gold, so it is interesting we are once again seeing stocks rally and gold pullback as we write this in late November. Gold usually jumps out of the gates in January so this ties in with our above forecast of a potential early 2021 low for the metals. Due to the difficulty of timing markets, dollar-cost-averaging into metals throughout December could be a better strategy. This seasonal buying strategy would have served investors well in 4 of the past 5 years.

Equity Market Volatility

The US stock market is a fascinating beast indeed. If at the beginning of the year you were told that we would see the COVID pandemic wreak havoc in the US with over 11 million people infected, 250,000 deaths, and a 30% drop in GDP, would you have placed a bet that the stock market would trade higher by the end of the year? Probably not, but alas, such is the nature of the US stock market, and it looks like the S&P500 will likely close out 2020 with a positive return.

It is hard to imagine a time in history when the US stock market was more optimistic than today. Previous Federal Reserve chair Alan Greenspan famously coined the phrase ‘irrational exuberance’ when describing the dot com bubble of the 1990’s, and that is perhaps a fitting description for what we see today.

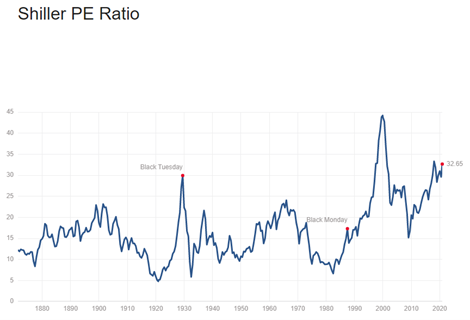

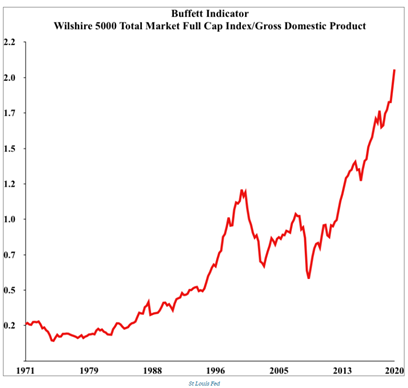

In terms of what this means for precious metals, generally the higher the valuation of the broader market the more at risk the market is to take big corrections should things not go to plan. Right now, the US stock market by measure of the Shiller Price to Earnings ratio is at the most expensive point in history, bar the 1990’s dot com bubble. The price to sales ratio of 2.7x is currently at the highest level ever. Warren Buffet’s ‘favorite indicator’ of market cap over GDP is at all-time highs, signaling a complete disconnect between the stock market and the economy. The tech sector is particularly stretched leading the market and very reminiscent of 1999.

All this adds up to a higher probability of lower expected returns for equities and a heightened risk of increased volatility in 2021. Weaker years in equities historically are met with positive years for precious metals, so a diversified and balanced portfolio has arguably never been more important than today. Our share market here domestically does not look anywhere near as bubbly in comparison to US markets, however there is no doubt that volatility in US equities would spill over into the ASX if that is indeed what we see in 2021.

Technical

In this weekly chart of USD Gold, we can see clearly that gold remains in a structural bull market with all moving averages in positive alignment despite the correction from the August highs. Things to note on a technical level is that the August spike was well and truly in overbought territory. The Relative Strength Index (RSI) was hitting above 70 and the parabolic nature of the market at the time indicated that gold had done too much in too short a time frame and was at risk of profit taking.

After the recent correction we are now trading in the oversold level if you look at the Williams %R Oscillator, currently signaling -92. These areas where the Williams %R is signaling oversold on a weekly chart have a very high percentage correlation with major lows in the market. Usually a good place to start dollar cost-averaging into the metals. Technically it is said that to wait until a move of the William %R back above the -80 level before making an entry, for those who want to time a low with confidence.

The weekly chart for silver is very similar. Overbought conditions of August 2020 have now subsided. However, silver has held up a bit better than gold and is currently not as oversold. So far there is no indication on a technical basis that the structural bull market in metals has ended, so expect investors to be buying into any significant dips throughout 2021.

Interesting to note, many investment banks have much higher precious metals price targets for 2021, including Goldman Sachs, which forecasts an average USD$2,300 for gold and Citibank which has a $40 price target for silver.

Some positive fundamentals for silver include the Silver Institute expecting a 7% decline in mine supply, whilst there could be some surprises with solar demand, including a potential US$2 trillion renewable energy spend in the US under a Biden administration. We also have the gold:silver ratio at an historically high 70:1, which could hint at another year of silver outperforming gold in 2021.

Global Debt Levels

Arguably the most important focal point as we move into 2021 is global debt levels. The global debt load has soared by $15 Trillion in 2020 to a new record $272 Trillion, or 365% of global GDP. Spurred by ultra-low interest rates and a sharp rise in government and corporate borrowings during the COVID crisis, the global debt tsunami just seems to be getting bigger every year. The elephant in the room that no one wants to pay attention to is something that should occupy the mind of any active investor.

The importance of debt and how it relates to precious metals performance is simple. Debt as it stands today, is at a level that would never be paid back without the help of Central Banks gradually destroying the purchasing power of the currencies in which the debt is nominated. Partly why Central Banks seem to have a never-ending printing press and an inflation target.

If a government clocks up too much debt, the Central Bank simply steps in with newly created money and buys that debt in the form of government bond purchases, or quantitative easing. The process is known as debt monetization and it’s been going on for quite some time now with no end in sight, with the Bank of Japan as the likely poster child.

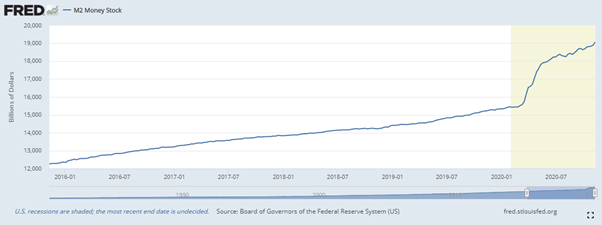

The higher a countries debt levels the more likely their Central Bank will lend a hand in monetizing the debt. The higher the money supply continues to grow, the less purchasing power the currency will have and the higher gold prices will rise in that currency. Gold has a stock to flow ratio of around 1%, which means all the gold that is ever mined (or supplied) into existing stock only adds about 1% dilution each year. This 1% natural inflation rate is nothing compared to fiat currencies which can see supply increases at a much faster rate.

If you view gold as a currency (which you should), then compare that increase in supply with say the increase in the M2 money supply in the US and you start to begin to understand why gold is such a stable and reliable store of value.

The M2 money supply in the US increased by over 23% in 2020 alone. Gold in $USD increased by around 21% in value, thus far. Not every year is this perfect a correlation between the money supply and gold performance, but you get the idea on a long enough time frame.

The increase in the M2 Money supply seen below correlates highly to the explosion in global debt seen above. The fact that global debt levels are so high is a primary reason why a gold investor can feel comfortable holding gold in their portfolio for not months or years, but for decades. Constant devaluation of currencies is almost as predictable as death and taxes.

Summary

Despite a stellar performance for precious metals in 2020, the outlook for 2021 remains structurally bullish. The average gold bull market lasts for 7 years, so we could have some length yet to go in this cycle. Look for the possibility of a significant low in both gold and silver occurring between now and the early months of 2021, as we currently trade in an oversold environment and have seasonality in favor.

Watch US bond yields closely as an indicator for a possible turning point in precious metals. The fact that an economic recovery is not guaranteed despite a successful vaccine means that Central Bank policy should stay accommodative throughout 2021 at least.

The problem of global debt is not going to go away overnight, even if dozens of pharmaceutical companies claim to have the world’s first safe and effective mRNA vaccine. The excessive global debt levels will prevent Central Banks from normalizing interest rates in any meaningful way, which will keep a lid on bond yields in 2021.

Lastly, the gold:silver ratio remains elevated on a historical basis, and the supply and demand fundamentals are strong for silver going into 2021. Silver is our pick to outperform gold once again next year.

To find out more feel free to call through and speak to one of our representatives or email your questions to sydney@guardianvaults.com.au

______________________________________________________________________________________________

SEE OUR LATEST UPDATED PERTH MINT PREMIUMS ACROSS GOLD AND SILVER

______________________________________________________________________________________________

https://www.pewresearch.org/science

https://tradingeconomics.com/united-states/government-bond-yield

https://www.fxstreet.com/analysis/the-santa-rally-approaches-a-halftime-break-202011200038

https://www.intellinews.com/attack-of-the-debt-tsunami-global-debt-soars-to-a-new-all-time-high-196972/

https://fred.stlouisfed.org/series/M2https://stockcharts.com/h-sc/ui

https://www.businessinsider.com.au/warren-buffett-indicator-nears-record-high-signals-stocks-risky-overvalued-2020-11?r=US&IR=T

https://www.multpl.com/shiller-pehttps://www.tradingview.com/chart/?symbol=SP%3ASPX

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.