Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Gold and Silver News

From Guardian Vaults

What is the real inflation number?

This week saw the release of US CPI data for the month of May, and after April’s surprise CPI print of an annualized 4%, we saw inflation continue to trend higher in the US with the official numbers coming in above expectations yet again at 5% on an annualized basis, the highest since August 2008. Gold’s reaction was somewhat sluggish, rising 0.5% on the day, as the market seems unconvinced that the inflation genie has been let out the bottle just yet. In this weeks update we look at alternative measures on inflation which could explain why the official CPI numbers have been so low despite the rapid expansion in global money supplies.

After another inflation beat, the question on investors’ minds will be: what if inflation continues to spiral out of control and what impact that will have on all financial markets? Generally speaking, your superannuation balance is likely to be upset by rising inflation as it means both equity markets and bond markets could sell off in an environment where central banks have to tighten policy to reel inflation in. So, this could mean lower stock prices, lower bond prices, higher yields and higher interest rates, with most likely higher precious metals prices as the race to hedge inflation begins. Alas, the S&P 500 still managed to finish the day in the green, as the CPI print was only 0.3% higher than expectations, so it seems there is not much that can upset the bull market in US stocks as the euphoria continues uninterrupted for now.

Whilst everyone will be focused on the headline inflation number of 5%, there is another way to look deeper into the numbers. Bianco Research notes that the combined 2% jump in core CPI over the past three months marks the fastest rise since 1982, and is actually equivalent to an 8.3% annual growth rate. But due to coming off such a low base in previous months it will be very interesting to see next month’s number, as the argument by the Fed thus far has been that inflation is ‘transitory’ and nothing to worry about. Please note that the Federal Reserve does not have the best track record for forecasting, so you can take their inflation forecasts with a grain of salt.

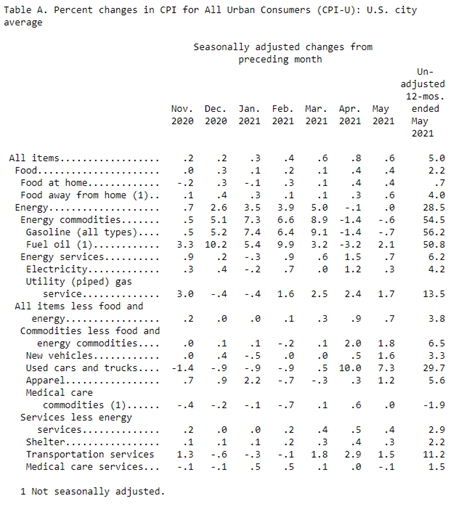

The inflation we experience in everyday life often seems to feel much higher than the official CPI numbers due to the way they calculate the basket of goods and what weighting certain goods have. From the US Bureau of Labor Statistics (BLS) themselves ‘The CPI is a statistical estimate that is subject to sampling error because it is based upon a sample of retail prices and not the complete universe of all prices.’ The accuracy of the official CPI is a bit questionable to say the least; however, Central Banks will base policy on the official CPI no matter how cooked it may be. The table below shows the breakdown of how US CPI is calculated and we can see the absence of financial asset prices such as stocks and property.

For an alternative look at inflation numbers in the US, you can take a look at John William’s Shadow Stats website, which shows what the inflation numbers would be if they continued to calculate it in the same way that it was in 1990 and also compares the older methodology used in 1980. According to Williams, ‘methodological shifts in government reporting have depressed reported inflation, moving the concept of the CPI away from being a measure of the cost of living needed to maintain a constant standard of living.’ You can see in the chart below the disconnect in the official inflation numbers soon after the methodology was changed, and based on applying the 1980’s methodology inflation in the US would actually be reported at over 10% on the recent May spike, and would have averaged close to 10% for the past 20 years. The old measure of inflation fits much better with the argument that gold is a natural inflation hedge, as the US gold price has averaged 9.6% per annum in the last 15 years. Much closer to the alternative 1980’s inflation calculation.

Even using the more recently adjusted methodology that the BLS would use in the 1990’s, the inflation number for May would have been recorded at over 8%. A conspiratorial angle would conclude that it may not be a coincidence that these changes in the way inflation is measured have led to much lower official CPI numbers, as there always seems to be a hidden underlying incentive for central banks to create as much asset price inflation as possible, without moving the dial of the official CPI. Something that would greatly benefit the rich VS the poor and potentially a good reason as to why the world has more inequality today than previous decades.

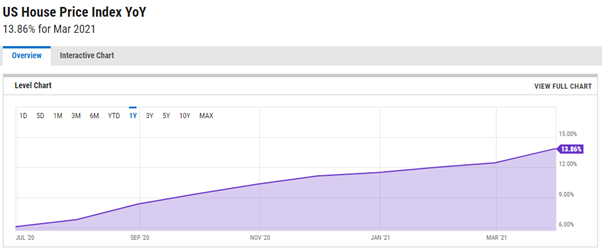

One potential flaw of the official US CPI calculation is that it doesn’t really capture the cost of buying a property. “Shelter” is listed as a component, however, shelter is calculated based on rental prices, or the potential rental prices that owner occupiers could hypothetically receive, if they rented their house out. From the BLS; ‘housing units are not in the CPI market basket. Like most other economic series, the CPI views housing units as capital (or investment) goods and not as consumption items.’ So the number one expense in most family’s lifetimes, the price of buying a family home, is not factored in to the official CPI number. In fact, anything deemed as an investment misses out of the calculation.

Why not just factor in the actual average cost of buying a house month to month? Well, that would mean the official inflation number would be much higher, and the Central Bank would have to wind back the accommodative monetary policy that is propping up the over indebted economy. The US house price index has risen 13.8% in that last 12 months, but no, this is not a relevant number for calculating how much prices are rising across the economy….

To point out how absurd the official CPI number is, the question put to consumers who own their own property in the Consumer Expenditure Survey is: “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?” To which the consumer responds with a complete guess off the top of their head, which then feeds through into the US official inflation number that central bank policies are based on. Official house price data is ignored, as anyone who buys a house is clearly just investing, right?

In this weeks update we look at alternative measures on inflation which could explain why the official CPI numbers have been so low despite the rapid expansion in global money supplies.

Until next week,

John Feeney

Guardian Gold Sydney

If you have any feedback or questions about this report, you can contact John Feeney direct at johnf@guardianvaults.com.au

Or on Twitter @JohnFeeney10

Disclaimers: Guardian Gold, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults” & “Guardian Gold”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Gold, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Gold, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Gold, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.