Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

Enquire Now

Please provide your details to reserve space at Guardian Vaults.

In The True Value of Gold (Part 1) we revisited the basic fundamentals of gold, in particular how the value of gold is derived from the perception of confidence in the prevailing system. We finished with a brief discussion on the correlation between the price of gold and market volatility as a result of major geopolitical events. This is where we will pick up again, in the grips of ongoing Brexit negotiations and the daily instalments of Trump’s presidency via Twitter.

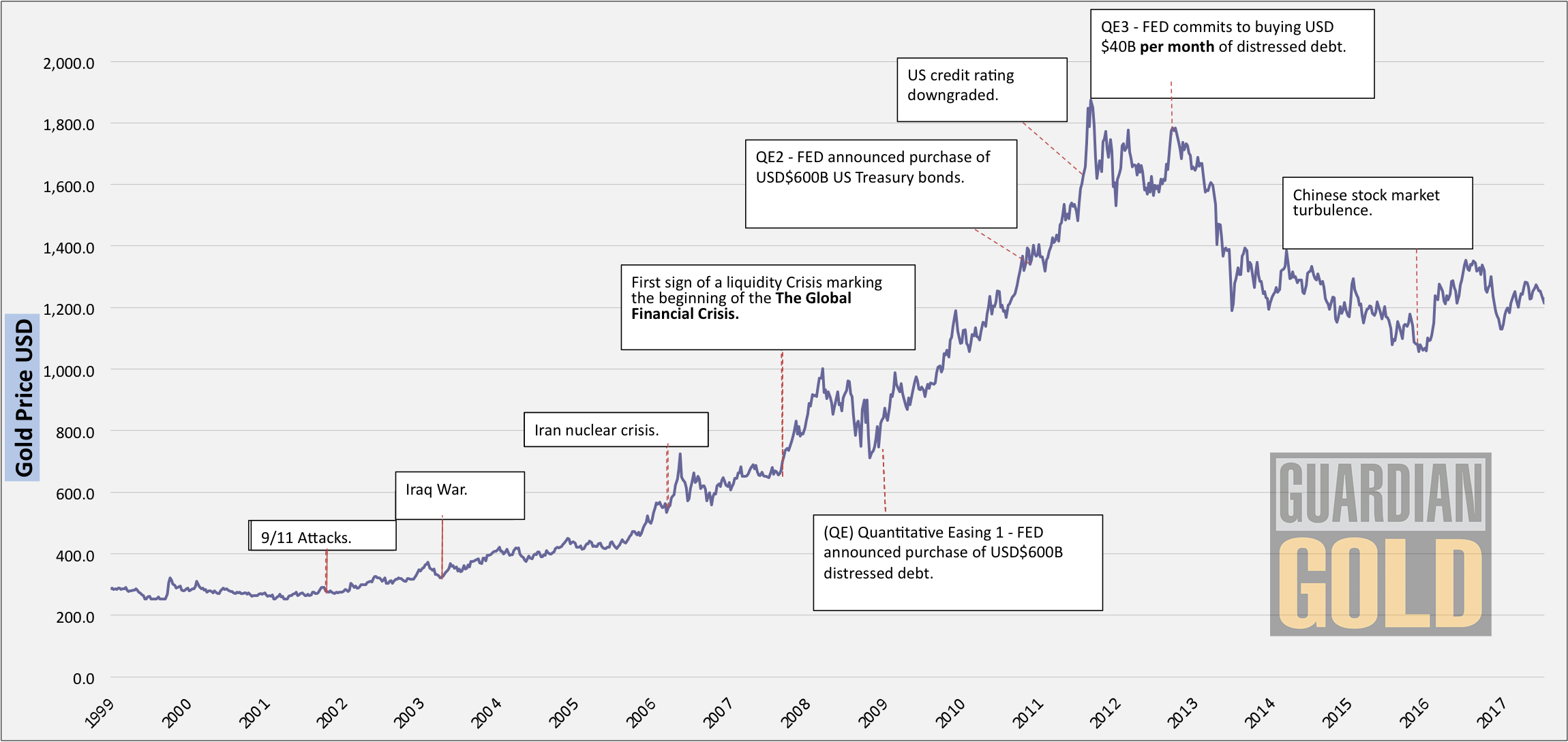

2016 will go down in recent history as one of the strangest years. If it has taught us anything, it’s to expect the unexpected – and then apply a healthy dose of chaos theory in an attempt to get closer to a projectable outcome. One could be forgiven for feeling as though there is an escalating trend of unforeseen events and their subsequent fallout. The below graph, however, highlights the frequency of such events occurring over the past couple of decades.

Chart 1.0

Source: World Gold Council

We generally see events like this fall into two categories. The first category is often referred to as a ‘Black Swan’. This type of occurrence is virtually impossible to predict, as we saw with the largely unforeseen Global Financial Crisis (GFC). The second category more frequently takes the form of a ‘saturation event’, gradually building momentum towards an outcome that may or may not materialise as predicted. Both scenarios typically witness varying levels of market volatility and more often than not result in a flight to safety assets.

Both the Brexit vote in June 2016 and the election of Donald Trump as President of the United States later that year are arguably the two highest profile geopolitical events of recent times. The lead up to both was entrenched in a media circus and marred by name-calling gutter politics, the likes of which has rarely been seen. It wasn’t only the voters in both examples that were stunned and divided by the outcome; the ensuing reaction suggests a large portion of the market found themselves on the wrong side of the trade.

The 52/48 decision for Britain to leave the European Union came largely as a surprise to everyone involved. The immediate after-effects sent markets around the world reeling in a state of shock. The British Pound had its worst day on record, falling almost 10% in the first 24 hours and continuing to fall to a 31-year low, ending the year 19% down vs. USD. The FTSE 100 had 50 billion pounds wiped off its value with the leading European equity markets quickly following suit. S&P Global estimated more than USD 2 trillion of paper wealth was erased on the Friday, rivalling the worst of the sell-offs witnessed during the GFC.

Investors piled into gold, fuelled by market panic and stories of dealers selling out of physical bullion; demand heavily outstripped supply. Gold predictably reaffirmed its historical position as the ‘risk off’ safe-haven trade, rising almost 5% the day following the vote to USD 1,315. Gold prices reached highs of USD 1,372 in August after the Bank of England cut interest rates in reaction to the Brexit vote and strong support persisted into October that year. However, weighed down by optimistic US economic data and an increasingly bullish dollar, the yellow metal give up those gains leading into the November US Presidential Elections.

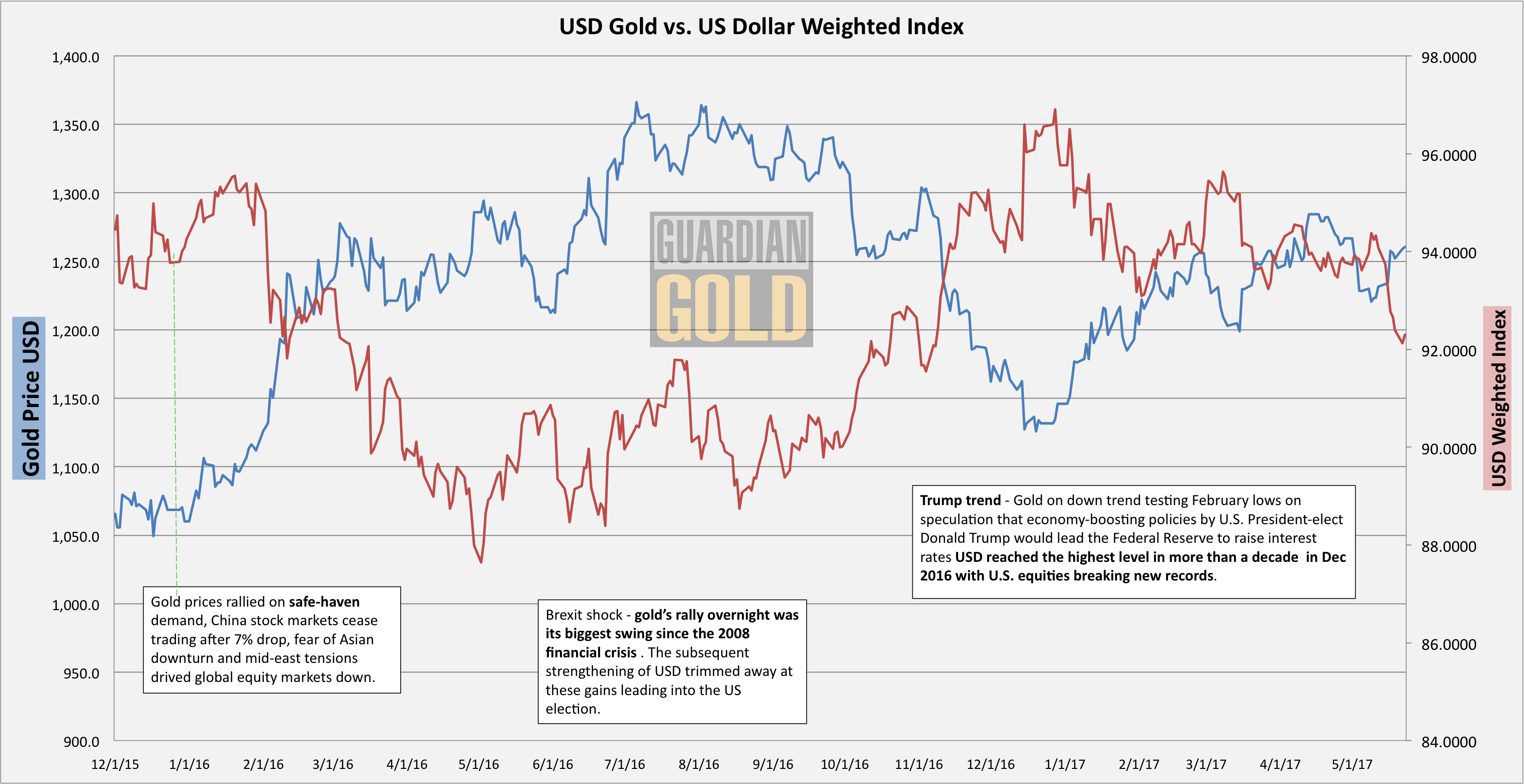

Chart 2.0

Source: FRED, Trade Weighted U.S. Dollar Index: Major Currencies; World Gold Council

“One of the key problems today is that politics is such a disgrace. Good people don’t go into government.” Donald J. Trump

Democrat candidate Hilary Clinton has a 98.2% chance of winning the Presidency – this was the prediction by the Huffington Post’ Political Editor the morning of the 2016 Presidential Election and they were not alone in this school of thought. NY Times gave Clinton an 85% chance of victory and the Princeton Election Consortium were 99% in favour of the Democratic candidate. Gold spiked close to 5% as the news of a surprise Trump victory started to become a realisation. Hitting a six-week intraday high of USD 1,337.40, the market retreated into gold to take stock of what just happened and attempt to process the possible implications of a Trump administration.

From a historical perspective, the way the gold price reacted immediately after the UK’s Brexit vote was much to be expected. Its response following the Republican victory, however, challenged many assumptions. The market’s initial uncertainty of a Trump presidency quickly subsided and it was ‘back to the races’. The pre-election promises of pro-business fiscal policy, stimulatory infrastructure spending and reduced corporation tax all greased the wheels of the ‘Trump train’, pushing equities to record highs and driving the continued strengthening of the US Dollar.

Federal Reserve policy added to the perception of growth and recovery with three consecutive 25 bps rate hikes in December 2016, March 2017 and June of 2017. The downward trend effect on the gold price and the inverse relationship to USD was striking and can clearly be seen in the Chart 2. Spot gold hit a 10.5-month low of USD 1,122 an ounce in mid-December 2016.

As the Chinese proverb goes, when the winds of change blow, some build walls and others build windmills. Trump to date has built neither. The momentum of the ‘Trump trend’ was built on the assumption that the US just elected a nonconformist, one who was not afraid to challenge the established status quo to deliver on those all-important election promises. The shine soon began to fade with increasing doubt that Trump would ever be able to successfully pass any of the fiscal policies beloved by the market. The months that followed saw the administration rocked by a series of scandals and subsequent calls for impeachment from Trump’s detractors.

The continued bombardment of negative news (the Russian election collusion, firing of James Comey, resignation of Mike Flynn, travel ban legislation failure and defeat of the Obamacare repeal to name a few) has seen pressure mount on the US Dollar. This, in turn, has seen gold return to its pre-election value. At the time of writing, betting on a September 2017 Federal Reserve, interest-rate decision has swung to almost 96% certainty of “no change” as tracked by CME’s FedWatch, suggesting a key change in the market’s perception of confidence.

Taking into account the experiences of the last 18 months, it would be a reasonable assumption to say we could witness increased geopolitical and market volatility, signalling interesting times for gold as these two events continue to play out on the global stage.

As always, please feel free to reach out to us to discuss anything touched on in the above.

Investments

From Guardian Vaults

The True Value of Gold (Part 2)

In The True Value of Gold (Part 1) we revisited the basic fundamentals of gold, in particular how the value of gold is derived from the perception of confidence in the prevailing system. We finished with a brief discussion on the correlation between the price of gold and market volatility as a result of major geopolitical events. This is where we will pick up again, in the grips of ongoing Brexit negotiations and the daily instalments of Trump’s presidency via Twitter.

2016 will go down in recent history as one of the strangest years. If it has taught us anything, it’s to expect the unexpected – and then apply a healthy dose of chaos theory in an attempt to get closer to a projectable outcome. One could be forgiven for feeling as though there is an escalating trend of unforeseen events and their subsequent fallout. The below graph, however, highlights the frequency of such events occurring over the past couple of decades.

Chart 1.0

Source: World Gold Council

We generally see events like this fall into two categories. The first category is often referred to as a ‘Black Swan’. This type of occurrence is virtually impossible to predict, as we saw with the largely unforeseen Global Financial Crisis (GFC). The second category more frequently takes the form of a ‘saturation event’, gradually building momentum towards an outcome that may or may not materialise as predicted. Both scenarios typically witness varying levels of market volatility and more often than not result in a flight to safety assets.

Both the Brexit vote in June 2016 and the election of Donald Trump as President of the United States later that year are arguably the two highest profile geopolitical events of recent times. The lead up to both was entrenched in a media circus and marred by name-calling gutter politics, the likes of which has rarely been seen. It wasn’t only the voters in both examples that were stunned and divided by the outcome; the ensuing reaction suggests a large portion of the market found themselves on the wrong side of the trade.

The 52/48 decision for Britain to leave the European Union came largely as a surprise to everyone involved. The immediate after-effects sent markets around the world reeling in a state of shock. The British Pound had its worst day on record, falling almost 10% in the first 24 hours and continuing to fall to a 31-year low, ending the year 19% down vs. USD. The FTSE 100 had 50 billion pounds wiped off its value with the leading European equity markets quickly following suit. S&P Global estimated more than USD 2 trillion of paper wealth was erased on the Friday, rivalling the worst of the sell-offs witnessed during the GFC.

Investors piled into gold, fuelled by market panic and stories of dealers selling out of physical bullion; demand heavily outstripped supply. Gold predictably reaffirmed its historical position as the ‘risk off’ safe-haven trade, rising almost 5% the day following the vote to USD 1,315. Gold prices reached highs of USD 1,372 in August after the Bank of England cut interest rates in reaction to the Brexit vote and strong support persisted into October that year. However, weighed down by optimistic US economic data and an increasingly bullish dollar, the yellow metal give up those gains leading into the November US Presidential Elections.

Chart 2.0

Source: FRED, Trade Weighted U.S. Dollar Index: Major Currencies; World Gold Council

“One of the key problems today is that politics is such a disgrace. Good people don’t go into government.” Donald J. Trump

Democrat candidate Hilary Clinton has a 98.2% chance of winning the Presidency – this was the prediction by the Huffington Post’ Political Editor the morning of the 2016 Presidential Election and they were not alone in this school of thought. NY Times gave Clinton an 85% chance of victory and the Princeton Election Consortium were 99% in favour of the Democratic candidate. Gold spiked close to 5% as the news of a surprise Trump victory started to become a realisation. Hitting a six-week intraday high of USD 1,337.40, the market retreated into gold to take stock of what just happened and attempt to process the possible implications of a Trump administration.

From a historical perspective, the way the gold price reacted immediately after the UK’s Brexit vote was much to be expected. Its response following the Republican victory, however, challenged many assumptions. The market’s initial uncertainty of a Trump presidency quickly subsided and it was ‘back to the races’. The pre-election promises of pro-business fiscal policy, stimulatory infrastructure spending and reduced corporation tax all greased the wheels of the ‘Trump train’, pushing equities to record highs and driving the continued strengthening of the US Dollar.

Federal Reserve policy added to the perception of growth and recovery with three consecutive 25 bps rate hikes in December 2016, March 2017 and June of 2017. The downward trend effect on the gold price and the inverse relationship to USD was striking and can clearly be seen in the Chart 2. Spot gold hit a 10.5-month low of USD 1,122 an ounce in mid-December 2016.

As the Chinese proverb goes, when the winds of change blow, some build walls and others build windmills. Trump to date has built neither. The momentum of the ‘Trump trend’ was built on the assumption that the US just elected a nonconformist, one who was not afraid to challenge the established status quo to deliver on those all-important election promises. The shine soon began to fade with increasing doubt that Trump would ever be able to successfully pass any of the fiscal policies beloved by the market. The months that followed saw the administration rocked by a series of scandals and subsequent calls for impeachment from Trump’s detractors.

The continued bombardment of negative news (the Russian election collusion, firing of James Comey, resignation of Mike Flynn, travel ban legislation failure and defeat of the Obamacare repeal to name a few) has seen pressure mount on the US Dollar. This, in turn, has seen gold return to its pre-election value. At the time of writing, betting on a September 2017 Federal Reserve, interest-rate decision has swung to almost 96% certainty of “no change” as tracked by CME’s FedWatch, suggesting a key change in the market’s perception of confidence.

Taking into account the experiences of the last 18 months, it would be a reasonable assumption to say we could witness increased geopolitical and market volatility, signalling interesting times for gold as these two events continue to play out on the global stage.

As always, please feel free to reach out to us to discuss anything touched on in the above.

Disclaimers: Guardian Vaults Holdings Pty Ltd, Registered Office, Scottish House, 100 William Street, Melbourne, Victoria, 3000. ACN 138618176 (“Guardian Vaults”) All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher and/or the author. Information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation. Guardian Vaults, its officers, agents, representatives and employees do not hold an Australian Financial Services License (AFSL), are not an authorised representative of an AFSL and otherwise are not qualified to provide you with advice of any kind in relation to financial products. If you require advice about a financial product, you should contact a properly licensed or authorised financial advisor. The information is indicative and general in nature only and is prepared for information purposes only and does not purport to contain all matters relevant to any particular investment. Subject to any terms implied by law and which cannot be excluded, Guardian Vaults, shall not be liable for any errors, omissions, defects or misrepresentations (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (direct or indirect) suffered by persons who use or rely on such information. The opinions expressed herein are those of the publisher and/or the author and may not be representative of the opinions of Guardian Vaults, its officers, agents, representatives and employees. Such information does not take into account the particular circumstances, investment objectives and needs for investment of any person, or purport to be comprehensive or constitute investment or financial product advice and should not be relied upon as such. Past performance is not indicative of future results. Due to various factors, including changing market conditions and/or laws the content may no longer be reflective of current opinions or positions. You should seek professional advice before you decide to invest or consider any action based on the information provided. If you do not agree with any of the above disclaimers, you should immediately cease viewing or making use of any of the information provided.